Aging

Retire the Selfie

Help yourself to more savings by connecting with your future self.

Posted May 14, 2014

In behavioral economics, time is the final frontier. Take the problem of delayed feedback. To change a behavior is not only difficult because it requires planning and willpower, it is also hard to appreciate a behavior—good or bad—when we receive delayed feedback about the outcomes of our actions. Smoking, for example, has slow, cumulative effects that are often not seen until many years have passed. The same is true for more desirable behaviors like saving for retirement.

Behavioral economics is a response to neoclassical economics’ assumption that we are rational and selfish creatures with relatively stable preferences. One domain of behavioral research deals with ‘intertemporal choice’, decision making in time, which challenges the assumption that preferences tend to be stable. “Temporal problems” partly occur because our memory of past experiences and predictions of the future are fraught with biases. But our worst enemy may be a lack of self-control and willpower. We are impulsive and habit-driven creatures who live in the moment and don’t like change. We procrastinate. We prefer smaller but immediate rewards over larger payoffs in the future. Behavioral economists working in the area of intertemporal choice refer to this as the time inconsistency problem and point to a misalignment between the preferences of our present (myopic) self and those of our future selves.

The most prominent application of these ideas occurs in personal finance. I have seen some creative proposals on how to deal with our financial shortsightedness, ranging from an ‘impulse saver’ app, to freezing your credit card in a block of ice, and partitioning financial resources into smaller units (e.g. multiple envelopes). I personally find money management software an indispensable tool to control and monitor my spending. Over time, taking care of my short-term budget has become largely intuitive. Long-term financial planning, on the other hand, is a lot trickier. Many Americans don’t build adequate savings for retirement. Let’s face it, how many of us like to plan for something that’s in the distant future at the expense of the present, let alone relish the thought of growing old in the first place?

One way to bridge the gap between our present and future self is by making a commitment to change, ideally a public one, as can be done on the website Stickk, for example. Pre-commitment to a goal is one aspect of the Save More Tomorrow initiative developed by the behavioral economist Richard Thaler. The program gives employees the option of pre-committing to a gradual increase in their savings rate in the future, each time they get a raise. It avoids the perception of loss that is felt with a reduction in disposable income (referred to as loss aversion by behavioral economists), because consumers commit to saving future increases in income. Individuals have to opt out if they later want to leave the program. This makes it more likely that people stick with the program, since most of us have a tendency for inaction (referred to as inertia by behavioral economists).

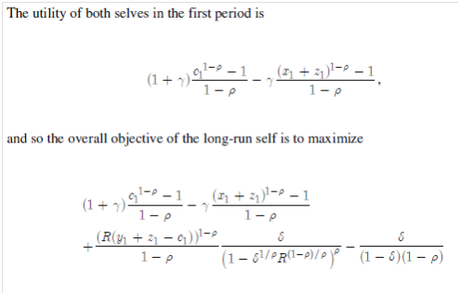

Some behavioral economists have used a present vs future self (‘dual-self’) model of impulse control and published utility functions, such as the following:

Mathematical approaches like these certainly occupy an important place in the advancement of (behavioral) economic theories. I would love to understand them, but as a psychologist I tend to work with simpler (statistical) methods. I also tend to be interested in research with more readily apparent practical implications. For example, one study suggests that behavior change could be achieved by helping people connect with their future self. It found that participants who were exposed to their future (as opposed to present) self in the form of an age-progressed avatar in virtual reality environments allocated twice as much money toward a retirement account.

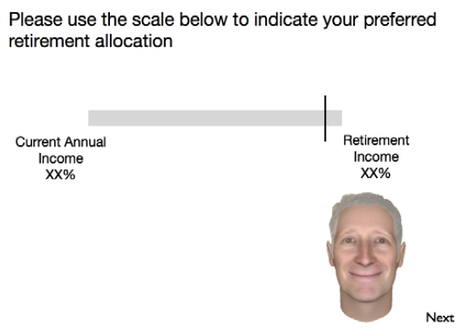

This wasn’t simply due to having been primed with the concept of aging. Another experiment showed that, compared to people who saw another person’s age-progressed image, those who were exposed to an age-progressed avatar of themselves were more likely to accept future financial rewards over immediate ones. Similar effects were found in a study that used less complex technology and incorporated age-progressed pictures in an online savings allocation task:

I think there may be a range of creative approaches that could help people increase their retirement savings. Traditional retirement income projections are quite static and impersonal, usually providing consumers with their expected pension, in today’s money. Making feedback more dynamic and the future less abstract would allow us to better connect present and future selves. As a bare minimum, your money management environment would need to graphically display your expected retirement income and how this compares to your current income. Age-progressed pictures of users would be a great addition. The program could even show pictures that represent retirement income scenarios. Forecasts and associated imagery would change dynamically depending on current savings levels.

If you don’t save enough for your retirement, your vacations might look more like this:

…than this:

And a lack of savings might be better represented by this pensioner diet:

….than this one:

Unfortunately, people get used to seeing the same visual cues and they may lose their impact over time. This can also be a problem when psychological research in the laboratory shows a stimulus to be effective. A manipulation may have a one-off measurable effect on people’s attitudes or behavior in the psychological lab, but no enduring effect in the real world. Maybe a more effective pathway for our present self to connect with the future self could occur via our experiencing self. For example, programs could be designed that allow people to experience their possible “future self” vicariously through other people. People could meet (virtually or in person) retirees with different levels of retirement income. Greater personal relevance could be achieved by matching them on the basis of personal characteristics in line with participants’ own profession, location, gender or ethnicity. Learning about the circumstances of poor (vs comfortable) retirees first-hand might be an effective deterrent (vs incentive) in financial planning. Instead of keeping-up-with-the-Joneses type of interventions that try to achieve behavior change via Web 2.0 aided social comparisons (e.g., leaderboards), Behavior Change 3.0 applied to retirement savings could be about “meeting the Joneses.”

Behavior change programs that rely on people’s own initiative are inherently self-selecting, even if it’s just a matter of setting up new software. Individuals who participate are usually also the ones who are motivated to make a change in the first place. Since we are all prone to a certain degree of laziness, it’s not surprising that the most-bang-for-the-buck behavioral nudges are those that work with these human flaws, such as pension auto-enrollment. And programs that rely on traditional economic incentives, such as tax breaks, need to remain the bedrock of government policy. But behavior change is a multipronged approach, and there’s always room for new and creative methods. One of them, it appears, would be to retire the selfie – literally.

Available from July 2014: The Behavioral Economics Guide 2014 on BehavioralEconomics.com (free download)