Adoption

The Blockchain Is Being Under-Hyped

Is blockchain technology getting overhyped? Or is it actually underhyped?

Posted May 9, 2017

I remember attending a conference audience in the late 1990s, back when everyone was complaining that the Internet was being irrationally overhyped. Eric Schmidt, who was then CTO of Sun Microsystems, took the stage and boldly pronounced, “Actually, I think the Internet is being underhyped”… he argued that the true impact of the Internet was going to be greater than we all imagined, and you know, he was right.

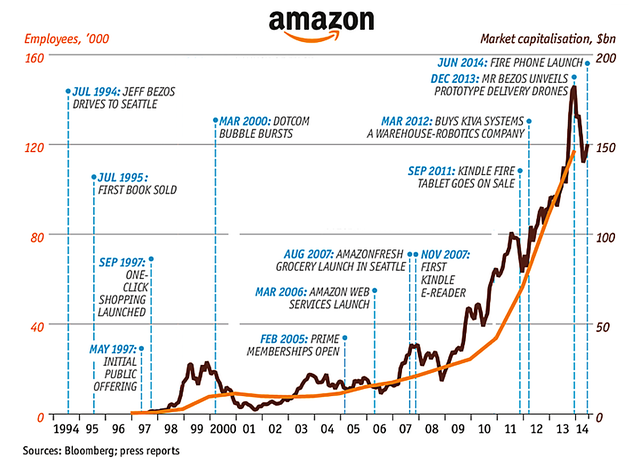

If you look at this chart below that shows the market cap for Amazon, you’ll see that the dotcom crash was really just a road bump before the long climb into the beautiful digital future. But that bump or pothole… it was the kind that could break your transaxle if you drove over it too fast. On the other hand, if you had given up and stayed out of the market entirely after hitting that bump, you would have missed one of the truly great rides of all time - i.e., if you had invested $10,000 at the IPO, it would be worth about $5 million today. Schmidt put this money where his mouth was, became the CEO of Google, and is now worth north of $10 billion, solidly in three comma territory.

It’s occurred to me that pretty much the same thing is happening with the blockchain right now. Blockchains are the latest and greatest technology that promise to change the world all over again. However, when addressing the subject, corporate executives need to sound rational and sensible, so they talk about the Gartner hype wave, how the bubble is eventually going to burst, and how we’re heading for a “trough of disillusionment.” I know Internet pundits who have to play it safe, and talk about how the blockchain is "probably" being overhyped; that it really isn’t ready for primetime yet, that it’s not secure yet, how it’s not scalable yet. They often conflate the blockchain with Bitcoin, and complain that it’s like a tulip craze, but without the tulips. But think of this: how is this not like saying in 1999, “Don’t invest in Amazon or Google, it’s a bubble!”

So we must ask, is the blockchain really being overhyped? Or is it actually being underhyped? What's the scoop and what's the spin?

What’s really happening is what Bill Gates said in "The Road Ahead”: “We always overestimate the change that will occur in the next two years and underestimate the change that will occur in the next 10.” If you’re going to try to make money in 2-3 years off the blockchain revolution, you’re probably going to get caught in a correction cycle. But if you’re looking to make some money over the next 7-10 years, and looking for a global infrastructural transformation play… the blockchain is probably a pretty good place to give it your best shot.

Waves of Innovation

People complain that they are confused about blockchains, that they don’t really understand them. But remember, this is just like what happened with the Internet when the Web was in its infancy. Global enterprises were confused about what a web page was, and their full ramification. It took a decade for people to figure it out. But the ones who did sooner, made all the money. So it’s something worth figuring out ASAP. If you’re reading this, you probably already know this, and have done your homework. So we’ll skip the normally obligatory "simplified explanation for beginners" that provides an imperfect analogy of what a blockchain is, and dive right into the more complex issues.

For example, here’s a peek into the nature of the blockchain technology adoption curve. It’s never a smooth ride, a simple linear growth curve all springing from a single invention. Instead, the world experiences a cascade of inventions that add together to form a much bumpier, but steeper curve of societal adoption. For example, the development of the Internet involved the creation of HTML, the subsequent adoption of the browser and the Worldwide Web, the critical mass growth of AOL, Microsoft’s adoption of an Internet strategy, the development of Java, the emergence of Google, and so on and so forth. In the Amazon example above, without a continuous string of hits, it never would have climbed to such heights.

In the same way, the blockchain revolution can only be successful if a similar cascade of interlocking technologies are developed. So what will it look like exactly? We think there will be three waves of technology, each exploding like a mini-big bang of application development, tools, and functionality. Like the transition from the web to Web 2.0 and then the mobile web, we will see a cascading series of mini-revolutions, each leveraging the technology and installed user base of the previous wave. And just like Thomas Kuhn explained in his book, “The Structure of Scientific Revolutions”, each wave becomes a paradigm that must be broken by the next.

Wave 1 is currently composed of “dumb ledger apps”, that address areas like remittance, cross-border payment and the correspondent banking system. However, we’re late to this game, so pretty much every bank and exchange is already on top of these obvious opportunities.

However, we’re still early for Wave 2, which is coming fast––these applications focus on “smart contract enabled distributed ledger apps”––or “dapps” in tech shorthand––which can revolutionize things like trade finance, music royalty management, IoT application management. You should note that these are very difficult problems to solve, so it may take years to develop the kinds of applications we’re hoping for, and don’t cause “unintended consequences”.

Finally, we will eventually see Wave 3 blockchain applications. These software systems integrate artificial intelligence, optimization and machine learning capabilities to elevate blockchain functionality. This arena is quite thought provoking in terms of how radical and unimaginable these new business processes can be. These are ‘blue ocean’ applications in vast undiscovered computational territories, that are replete with potential for exponential innovation and accelerated collaboration.

For Wave 1, the equivalent of HTML and HTTP will be the core blockchain architecture, which will supported by the release of ancillary technologies like sharding for scalability. Wave 2 will be based on smart contract technology and standards, which will be supported by technologies from Digital Assets Holdings and Ethereum. And for Wave 3, we’ll see new emerging standards like DID (decentralized identifiers), blockcerts, and verifiable claims.

So why the Fuss?

Let’s look at three examples of blockchain applications from each Wave, to better understand the likely impact and potential for societal transformation. It isn’t until we can understand the scope of the blockchain revolution, we can’t estimate its complete and likely impact.

Wave 1 example: Ripple

A perfect example of a Wave 1 blockchain venture is Ripple. Ripple uses blockchain technology to enable a new way to do inter-bank commercial payments and cross-border transfers. Currently, these types of payments use a network of banks without a central clearing house or authority, and transactions could cost as much as $30, and usually take more than a day to complete. Plus, at the point of initiation, the exchange rate and transaction fees can be unknown. The funds can move through many banks before reaching their destination, each with the potential for errors and additional fees. Customers often experience delays, high costs and uncertainties in managing these payments.

Ripple, in contrast, offers a real-time, 24/7, synchronous, transparent and information rich transactions. Payments are immediate with real-time confirmation, certainty, and transparency of rates and fees prior to the transaction. The Ripple solution joins payment messaging with fund settlement, which has proven itself with domestic payment schemes and card systems like MasterCard and Visa.

The opportunity to initiate a Ripple-based network currently exists, as thousands of banks can be reached via correspondent banking that engages in cross-border payments, representing 10 to 15 billion payments with a yearly value of $25 to $30 trillion. The Ripple solution reduces the cost of settlement, possibly by over an order of magnitude, by allowing banks to transfer and settle funds instantly and creates revenue opportunities by allowing access to new markets such as micropayments.

The Ripple example allows us to better understand the functionality and impact of Wave 1 blockchain applications:

- Dis-intermediation: The blockchain can eliminate middlemen, from brokers to notaries, to reduce the cost of finding, effecting, verifying and settling transactions.

- Payment: The blockchain will make it easier and cheaper to make payments, transfer money, or buy and sell goods.

- Stored Value: The blockchain can allow you store money digitally instead of using a bank, money market fund, or government security. It is possible to create smart contracts for treasury bills, to earn interest on your digital holdings, which could make savings accounts obsolete.

- Blockchain Lending: You will someday be able to make, secure, settle, and trade loans on the blockchain faster and easier than today.

- CyberFunding: Raising money now requires third parties such as investment bankers, venture capitalists, and lawyers––and triggers very expensive regulatory requirements. The blockchain could automate this process and reduce risk so regulatory agencies would enact a smaller costs. This will allow enterpreneurs to have greater access to capital than ever before, at the same time reducing risk for investors.

- Insuring: The blockchain supports decentralized models for insurance that can make risk management more efficient. This will lower premiums overall.

- Accounting: The blockchain enables something called “triple entry accounting”, which could make bookkeeping virtually automatic, transparent and instantaneous… enabling an era of “self-auditing” accounting. This will reduce the cost of accounting and CPAs.

The primary inhibitor for mainstream adoption is still scalability: the Bitcoin blockchain is only capable of doing around 7 transactions a second, whereas the Visa network can process about 90,000 transactions. Well, new blockchain technology vendors, like BigchainDB in Germany, have released blockchain based solutions that can process several hundred thousand writes per second. This means that we are near the cusp of market deployment of real solutions, that could bring mainstream adoption.

Wave 2 example: Trade Finance

A perfect example of a Wave 2 blockchain application is in trade finance. What exactly is trade finance? It’s when two companies in different countries want to buy and sell from each other. They normally use a bank to guarantee the transaction, and it’s a slow and expensive process which hasn’t changed much in 400 years. It requires a mountain of paperwork, and all the parties involved spend a great deal of their time proving that they truly own what they say they own.

Using a blockchain with smart contract capability could significantly transform this $7 trillion industry. For example, in February 2017, a cargo shipment containing $25 million worth of African crude slowly made its way to China. The merchants involved sold and resold the oil three times during the trip. Banks, agents, inspectors, and a commodity trading firm were all involved. The traditional solution involved hundreds of documents and it took at least three hours to complete each trade.

But on this trip, each trade took less than 25 minutes. The name of the pilot project that made this possible is called Easy Trading Connect. It’s a partnership between Société Générale and ING. And it works by moving the transactions to a private version of the Ethereum blockchain.

Saving time wasn’t the only benefit of the trade. ING reported that trader efficiency improved by 33% and reduced costs by 30%. Physical documents are prone to human error, fraud, and delays. With the blockchain, all documents get digitized. That makes documents easier and safer to move around. And it solves a lot of paperwork problems. Further, they were able to “auto-check” documents on a computer rather than doing it manually. Experts now estimate the blockchain will cut trade finance costs up to $20 billion.

The trade finance example allows us to better understand the functionality and impact of Wave 2 blockchain applications:

- Paperwork reduction: The blockchain can help to manifest the dream of the paperless office, reducing costs, speeding transactions, and insuring greater trade security.

- Insuring: The blockchain supports decentralized models for insurance that can make risk management more efficient. This will lower premiums overall.

The primary inhibitor for mainstream adoption is the difficulty of smart contract programmability. The idea that everything should be programmable was likely conceived by a programmer. But it's true, smart contracts are hard. It's going to take years to figure out how to avoid unintended consequences of more complex smart contract terms that auto-execute in ways you didn't really want to. Like ERP systems, vendors of smart contract technology tend to promise the moon, and this could generate its own trough of disillusionment.

Wave 3 example: Trust Objects

Finally, Wave 3 blockchain applications are much harder to talk about, but the seeds of these advanced intelligent applications are already germinating. Consider for example the emerging landscape of decentralized identity and trust. We call this technology “Trust Objects” – persistent, distributed decentralized, encapsulated trust datagrams based on a new technology of "verifiable claims" that embody the fundamental quantum of trust over the web, and could be exchanged by business partners and to create an eco-system of global "trustworthiness".

For example, a certified financial planner would get trust objects from the university he studied at, the governmental entity that certified him, the bonding agency that provided a bond, and all the customers who provided positive digital references - all of these would reside on the blockchain, and would enable an eco-system of trust for the business network and multiple parties could help verify claims or rate and manage trust objects.

Returning to the idea of entrepreneurship, a new company without much operating history (maybe no revenues) might be able to offer data that a bank would accept as validation that they would be able to repay a loan from the bank. Kinds of data that could support credibility: (i) personal borrowing history of the principals, (ii) professional/educational credentials, (iii) employment records, (iv) inventions, etc.

Trust objects could be designed and created for each of these data types. By the way, a key enabler of the loan-facilitation functionality would be for the government to offer "loan/repayment guarantees" to startups seeking bank loans - the trust system could help to gauge risk for those guarantees as well.

The Trust Object example allows us to better understand the functionality and impact of Wave 3 blockchain applications:

- Transactionalization: Trust objects turn blockchains into marketplaces, which is the hallmark of Wave 3 applications

- Next Generation Open Innovation: Enable the development of research collaboration using new models of non-binary trust

- Predictive Partnering: Make it easier to find trustable partners, vendors, and even customers

- Easier Money: Improve the fundraising process for startups, making it both easier for companies and safer for investors

- No More Spam: It could even end spam, if the system is accessed to empower the global email framework

The list is actually endless, once you dig into the possibilities of second and third generation blockchain applications, that could produce disruptive transformations in every sector of the global economy, from music production to media distribution, from marketing to sales, from healthcare to insurance to the Internet of Things. When you look at the breathtaking potential of Wave 3 blockchains for growth and expansion, you can see that the long term picture probably overshadows any potential road bumps we’re facing short term.

What are the inhibitors? It's way too soon to predict. But I can assure you that there will be plenty of road bumps and hiccups along the way. So it's important to remember... it's the journey, man. It's the journey.

In college, I learned the theory behind building atomic bombs from a Manhattan Project scientist. The key is to achieve critical mass without “pre-fizz” – which happens if you go too fast, or “post-fizz” by going too slow. Getting pulled into a mania would definitely lead to a pre-fizz, that could spoil the potential for achieving critical mass, like it did for nano and cleantech. But at the same time, going too slow would also spoil the rare exothermic reaction we seek. So let’s not get crazy about it, but at the same time, let’s be realistic, and work together to achieve critical mass for blockchain technology.

If the blockchain revolution does indeed achieve critical mass, we’re looking at a very interesting decade ahead. Let's have some fun with it!

Note: if you're interested in the social psychology of decentralized trust and blockchain usage, please bookmark my feed as I'll be writing about it extensively.