Aging

Why Don't We Save Enough for Our Retirement?

Uncertainty about “The Number” & misunderstanding how money grows are obstacles.

Posted November 6, 2016

When they retire, Dutch citizens really have it good. Not only does everyone receive a basic income of approx. € 1,000 from the state when they turn 65, but most people (as many as 90% of the citizenry) also get employer-administered pensions that generously provide 85% to 95% of what their earnings. It is no surprise that the Dutch pension system is among the best in the world, and the source of much envy.

In the US, and elsewhere, however, things are a lot bleaker. While most Americans receive social security (similar to the Dutch basic income), it is nowhere near enough to replace pre-retirement income. Any other money must come from what people have saved themselves for retirement over their working years. Financial experts are concerned that a majority of Americans are not saving enough money for retirement, and that in fact, we are in the middle of a retirement savings crisis that will only grow in severity.

I have written before about how optimism can lead people to postpone saving money. In this post, I want to explore three other psychological reasons for why people do not save enough for retirement. Surprisingly, none of these reasons have to do with earning sufficient money. Instead, they are all psychological and have to do with the person's knowledge and motivation. The idea behind this post is that if we can understand these reasons properly, it will give us some ideas about how to go about solving the retirement savings problem, at least for ourselves individually.

1. Setting a clear target retirement savings goal is really, really hard.

Although the conventional wisdom is that people retire when they turn 65, the reality is much more complicated, especially since the great recession. People are living longer, and so Americans routinely spend decades in retirement. During this time, many people continue to work full-time or part-time, or even begin a whole new career. Others retire prematurely because of health issues or because they get laid off and can't find another suitable job. After they retire, some people increase their spending by traveling a lot or indulging in expensive hobbies they have dreamed about throughout their working lives. Others downsize significantly, spending a fraction of what they spent before. Because of these enormous variations, and the inherent uncertainties about lifespan, health, and even the financial environment in which their investments will grow, it is very difficult to figure out exactly how much money one will need to save for retirement. In other words, there is no “magic number” or specific target to aim at.

Saving goals are problematic anyway. Decades of psychological research on setting and pursuing goals shows that abstract goals are the most difficult goals to pursue. People have difficulty developing a plan of action for abstract goals, and they are more likely to procrastinate and avoid pursuing them. Where retirement savings are concerned, without “the Number” to aim at, goal pursuit is hampered for many people.

2. Getting started with retirement saving & then adding to the savings regularly are two huge problems.

When setting a monthly budget, or making purchase or other financial decisions, retirement seems like a distant milestone, somewhere over the horizon. Other nearer-term, and more specific, financial goals take priority. In their 20s and 30s, individuals pay off their student loans, and save money for a down-payment on their first house. In their 40s, saving for children’s college education, and paying down the mortgage becomes important. And in their 50s, people are saving for (or paying off) discretionary purchases like vacations, second homes, boats, or RVs. At every life-stage, other financial goals seem far more salient, and the resulting accomplishments far more significant, than saving money for retirement.

It’s not that people don’t have a sense of urgency about saving for their retirement. When asked, people consistently say they do have retirement saving on their radar. For example, in one survey of 2,700 millennials conducted by the financial services company Aegon, 41% of respondents indicated that they aspired to save for the future, and 37% felt “very responsible” for their retirement savings. In another survey by Wells Fargo, 61% of respondents expressed urgency. Yet, this sense of urgency does not translate into action. In the Aegon survey, for instance, only 9% of the millennial respondents indicated that they had an actual saving plan for their retirement

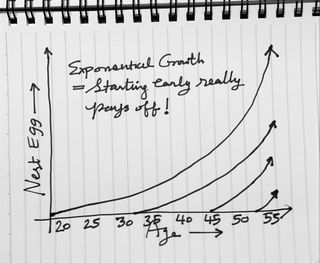

3. Many of us don't understand how exponential growth works and why it is important to saving now, without waiting for a single day longer.

One of the most significant characteristics of retirement savings (and actually, any saving) is that because of the magic of compounding, the money grows exponentially—increasing ever more rapidly as time passes and it grows in value (see adjoining figure). Consequently, starting saving money sooner leads to a disproportionately larger nest egg, and there is a huge cost to waiting to save money. However, as I have written before, people have difficulty with understanding how growth works, and can make cognitive errors.

Research by consumer psychologists Craig McKenzie and Michael Liersch gives some useful insights about this issue. They showed that people are not able to accurately estimate the outcome of such non-linear processes. Instead, they believe that savings will grow linearly, and underestimate how much their current savings will be worth in the future. In one study, for example, participants estimated that saving $400 per month and getting 5% return annually would grow to $200,000 after 40 years, when in fact, it would grow to over $600,000. The authors’ conclusion is grim:

“People’s failure to recognize the power of compound interest—especially over long periods of time—leads to gross underestimation of future account balances, and by consequence, the cost of waiting to save. The unfortunate byproduct of this underestimation is that it has a negative impact on people’s motivation to save now. Since the benefit of compound interest is reaped by saving over long periods of time, this lack of motivation is particularly threatening to young people’s attainment of their retirement savings goals.”

These three factors, a lack of clarity about a specific goal, the constant competition with other shorter-term and more specific financial goals, and failing to value the power of compounding, all contribute to delay and lack of focus about retirement savings. So how should we tackle these problems that are driven by people’s knowledge and motivations? I will explore potential solutions in a future blog post.

About Me

I teach marketing and pricing to MBA students at Rice University. You can find more information about me on my website or follow me on LinkedIn, Facebook, or Twitter @ud.